Canadian retail spending growth remained listless in June with a 0.1-per-cent month-to-month gain to reach $65.9 billion.

Higher auto-related sales helped but year-over-year sales were down 0.6 per cent. Adjusted for retail prices, real sales fell 0.2 per cent, adding to evidence that the economy is indeed slowing.

That said, this was good news for households being pummelled by interest rate hikes, as softer economic data supports the case for an interest rate pause in September. Cumulative rate hikes continue to work through the economy to stifle excess demand. Nonetheless, it is still early in the slowdown as estimates provided by Statistics Canada for July suggest retail sales rebounded 0.4 per cent during the month.

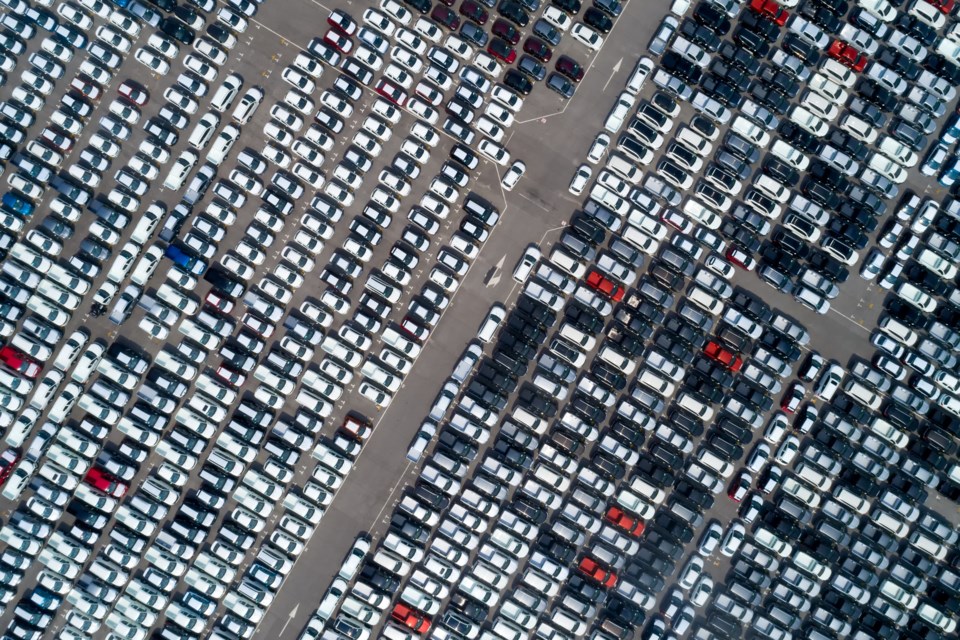

In B.C., retail spending reversed course after a huge May gain (4.8 per cent) with a 4.2-per-cent decline from May’s peak to $8.9 billion as motor vehicle sales retraced. Year-to-date sales rose 1.2 per cent. At the store-segment level, data is unadjusted for seasonality. Year-over-year retail sales of motor vehicles and parts were up 1.9 per cent, but down from May’s 15.5-per-cent pace, which contributed to the monthly decline.

Year-over-year retail sales at gasoline stations and fuel vendors decreased 21.2 per cent, falling further from the 19.1-per-cent yearly decline reported in May. Housing-related expenditures decreased with building material and garden equipment and supplies dealers’ sales dwindling to 16.6 per cent.

Furniture, home furnishings, electronics and appliances retailers’ sales increased 2.7 per cent but were less than the 4.8-per-cent increase in May. A slowdown in the housing market likely contributed to the decline. Food and beverage retailers saw sales grow 3.8 per cent.

Adjusted for seasonal factors, Vancouver metro area retail sales declined 3.1 per cent on lower motor vehicle and parts dealers’ sales. Year-to-date sales were unchanged with a 0.1-per-cent increase in the area.

The number of non-resident visitors entering Canada through B.C. increased in June. On a seasonally adjusted basis, there were 3.3 per cent more non-resident visitors in June than there were in May, at 646,050 people. The consecutive growth in visitors during these recent two months offset the losses seen in early spring. The increase in June was attributed to both same-day excursions and overnight stays, which were up 3.3 per cent and 2.4 per cent, respectively.

The number of U.S residents visiting Canada through B.C. was up 3.9 per cent from May to June. Over the same period, the number of residents from other countries edged down 1.3 per cent.

The increase in U.S. resident travellers was seen across all travel modes. Air entry from U.S. residents was up 1.4 per cent and automobile entry up 4.7 per cent. Other modes of transportation rose 4.3 per cent following a decline in May. Residents from other countries arriving by air decreased by 2.8 per cent; arrivals by land or water rose by 4.2 per cent.

Travel has recovered well from the pandemic, but all measures are still below levels seen in 2019. Cruise vacations remained popular, as Canadians took 21,000 cruise trips in June 2023.

Bryan Yu is chief economist at Central 1.